Services

Comprehensive Financial Solutions for Startups & SMEs

From Compliance to Strategy—We’ve Got You Covered

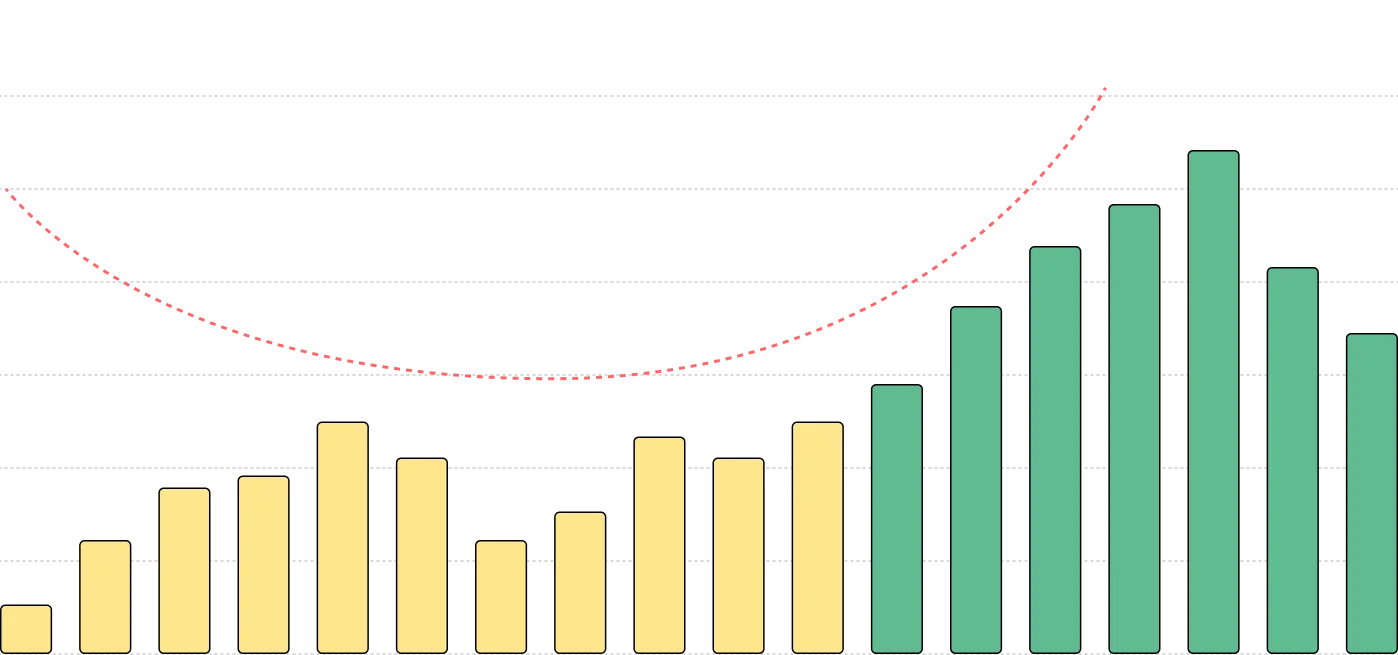

Financial Planning & Forecasting

Key Services

Our Comprehensive Financial Services

We offer a wide range of financial and accounting services designed to help your business stay compliant, organized, and financially healthy.

End-to-End Accounting

From bookkeeping to financial reporting, we handle all your accounting needs so you can focus on growing your business.

Virtual CFO Services

Get expert financial guidance without the cost of a full-time CFO. We help you make informed decisions and plan for the future.

Tax Compliance & Auditing

Stay compliant with GST, TDS, and other tax regulations. Our team ensures your filings are accurate and on time.

End-to-End Accounting

Ideal For:

Startups and SMEs with limited accounting bandwidth.

What We Do:

Our comprehensive End-to-End Accounting service is designed to streamline your financial operations. We perform weekly and monthly visits to manage your books, process invoices, and ensure timely vendor payments. Our experts handle essential tasks such as GST/TDS filings and generate detailed MIS reports, including Profit & Loss, Cash Flow, and Balance Sheet statements. As year-end approaches, we provide robust audit support to ensure your business is always audit-ready.

Benefits:

- Cost Savings: Save up to ₹15k/month compared to maintaining a full-time in-house accountant.

- Operational Continuity: Avoid disruptions caused by staff turnover through our reliable, ongoing support.

- Enhanced Compliance: Stay current with regulatory requirements and focus on growing your business.

Virtual CFO Services

Ideal For:

SMEs needing strategic oversight without the cost of a full-time CFO.

What We Do:

Our Virtual CFO Services provide strategic financial leadership without the overhead. Our seasoned professionals review the work of junior accountants, manage tax compliance, and develop detailed financial forecasts and budgets. We also offer staff augmentation during peak seasons, ensuring you have the right expertise exactly when you need it.

Benefits:

- Cost-Effective Expertise: Get access to strategic CFO insights at just one-third the cost of a full-time CFO.

- Data-Driven Decisions: Leverage detailed analytics for scalable, informed business decisions.

- Operational Efficiency: Enhance financial oversight and streamline processes with professional guidance.

Statutory Registrations & Compliance

Ideal For:

New businesses navigating legal and statutory formalities.

What We Do:

Starting a business involves multiple regulatory hurdles. Our Statutory Registrations & Compliance service simplifies this process by handling PAN, TAN, GST, MSME, IEC, Shop Act, and company incorporation. We also provide ongoing compliance updates and timely filings to keep your business aligned with regulatory requirements.

Benefits:

- Regulatory Peace of Mind: Avoid penalties with timely submissions and up-to-date compliance management.

- Streamlined Processes: Let our experts navigate the bureaucratic maze for you.

- Smooth Business Launch: Focus on growth while we handle the legalities.

Tax Auditing & Compliance

Ideal For:

Businesses preparing for internal and external audits.

What We Do:

Our Tax Auditing & Compliance service prepares your business for any audit scenario. We perform thorough risk assessments and implement tailored mitigation strategies, ensuring that your financial data is audit-ready. Our support covers GST, income tax, and TDS audits, reducing legal risks and enhancing compliance.

Benefits:

- Audit Readiness: Maintain impeccable, audit-ready records for stress-free audits.

- Risk Mitigation: Identify and address potential compliance issues before they escalate.

- Expert Guidance: Leverage our deep understanding of tax laws to ensure smooth audit processes.

Financial Reporting & MIS

Ideal For:

Businesses seeking actionable insights and real-time financial performance monitoring.

What We Do:

Our Financial Reporting & MIS service delivers tailored financial insights. We create customized Profit & Loss statements, conduct detailed cash flow analyses, and track budgets accurately. With real-time dashboards displaying key performance indicators, you gain an actionable overview of your financial health to drive strategic decisions.

Benefits:

- Data-Driven Insights: Identify trends and optimize resource allocation through detailed reporting.

- Investor Confidence: Impress stakeholders with professionally prepared financial documents.

- Operational Excellence: Monitor performance in real time and adjust strategies accordingly.

Accounts Payables & Receivables

Ideal For:

Companies focused on streamlining cash flow management.

What We Do:

Our Accounts Payables & Receivables service ensures smooth cash flow management by handling vendor payments and customer invoicing efficiently. We conduct ageing analysis to reduce overdue payments and optimize liquidity, ensuring that your business maintains strong financial relationships and operational efficiency.

Benefits:

- Improved Cash Flow: Ensure timely collections and payments to maintain financial stability.

- Stronger Relationships: Build trust with vendors and customers through efficient financial operations.

- Enhanced Liquidity: Proactively manage cash flow for sustained business growth.

Staff Augmentation

Ideal For:

Businesses needing temporary or project-based accounting support.

What We Do:

Our Staff Augmentation service provides skilled accounting professionals to support your business on a temporary basis. Whether you’re facing seasonal peaks or specific projects, our experienced team members integrate seamlessly into your operations, ensuring continuity and precision in financial management without the long-term commitment of permanent hires. Our professional services help in case of employee turnover/long leave of existing accountant. Business operations do not discontinue due to this.

Benefits:

- Cost Savings: Reduce recruitment and overhead costs with our flexible staffing solutions.

- Scalable Support: Quickly scale your team during busy periods without long-term commitments.

- Expert Assistance: Access a pool of seasoned professionals with specialized accounting expertise.

GAAP & IFRS Analysis

Ideal For:

Businesses expanding globally and needing to meet international accounting standards.

What We Do:

Our GAAP & IFRS Analysis service ensures that your financial statements meet global standards. We meticulously review your financial records to guarantee compliance with both GAAP and IFRS, preparing your business for international audits and enhancing credibility with foreign investors. Our expert analysis helps navigate the complexities of cross-border regulations and financial reporting.

Benefits:

- Global Compliance: Ensure your financial reports adhere to internationally recognized standards.

- Investor Attraction: Build trust with foreign investors through credible and transparent financial reporting.

- Seamless Expansion: Navigate international regulations with expert guidance for smooth global operations.

Ready to Elevate Your Finances?

Discover how our suite of end-to-end accounting, virtual CFO, tax auditing, and compliance services can streamline your business. Book a free consultation and let our experts tailor the perfect financial strategy for your startup or SME.

How we can help you:

Assess current financial processes and identify key improvements. Recommend strategies to ensure compliance and reduce risks. Provide personalized solutions aligned with your growth goals.